One of the few good things about getting sacked from a bank is that, if you're a Bloomberg user, you occasionally get a free trial subscription to the service for 60 days after your "right-sizing". Mine was just activated today, and it's nice to be able to play around with this wonderful tool again after a hiatus (one strange aspect of the "consultation period" in UK employment law being that, once identified as being "at risk of redundancy", you are sometimes thereafter treated as a de facto outsider, and barred from accessing corporate IT, at least this was the case for me - really gives you a warm, fuzzy sort of feeling...).

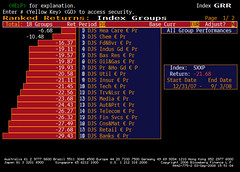

Anyway, rant aside, I was getting back in the loop of market technicals today, and downloaded this chart of ranked returns in the DJ STOXX 600 industry groups. Historically, I think many analysts, including yours truly on some occasions in the past, have argued that telco is a defensive sector in a market downturn (as it was at least for three months following 9/11). It's therefore interesting to note that telco, on a year-to-date basis, is 14th out of 18 sectors (down 26%), and the ones below it are non-bank financials (i.e., consumer credit, et al), construction and construction materials, retail, and banks.

In other words, telco is just managing to outperform the four sectors universally acknowledged as obvious casualties of the credit hangover. But wait, broadband and mobile are established as essential services, like electricity and water - what's going on here? De-leveraging is complete, the era of stupid M&A (DT aside) is over, "market repair" is complete or underway in a number of markets, so what's the problem?

I'll be honest and say I don't really know. Looking at the rankings on a one month basis, telco rates 12th out of 18, on a three-month basis it's number seven, and on six months, number 14. So clearly there's a lot of volatility in investor sentiment, but in all four cases, the financials are somewhere close in the rankings. I'm sure telcos would love to be acknowledged as serious financial services players, but there are no examples yet in Europe to warrant such an association - and I can't see any obvious factors to explain such an apparently strong correlation.

Wednesday, September 03, 2008

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment