This unemployment thing seems to be turning into a full-time job, so apologies in advance for the relatively unfocused digest nature of this post.

The equity markets have staged a nice rally, after yesterday's historic carnage. Great...if you're lucky enough to be completely free of having to deal with the credit markets. In point of fact, today's rally seems to underline a phenomenon which my former colleagues and I used to regularly marvel at - the yawning disconnect between the credit and equity markets. The chart at right shows the overnight LIBOR rate, i.e., the interest rate at which banks are willing to lend to one another overnight. Yes, it shows a dramatic spike, and yes, the spike constitutes an historic high. If large banks demonstrate their mutual mistrust to this extent, then what are the chances of a small business getting even the most modest funding for working capital? How many small businesses have to find their access to short-term finance constrained before their suppliers and customers find themselves seriously stuck? What are the implications as this dynamic plays out across the economy, and how might this situation displace other priorities? The answer, my friend, is blowing in the wind, I'm afraid, and this is the central problem confronting us all now. Every day the politicians delay merely amplifies the problem.

Nevertheless, I'm amazed (I'm probably going to piss some people off at this point) at the extent to which some people seem to think that NGA development might be miraculously decoupled from the real economy (or perhaps they hadn't picked up a recent copy of the Wall Street Journal). I would argue, more vociferously than most, that FTTH is an essential investment in the future of our country (pick the nation of your choice), but if we have to choose between NGA and dealing with mass unemployment, business failure, and homelessness, then NGA must lose out, at least in the short-term. Trust me, when Obama, McCain, Pelosi, Paulson, Bernanke, Brown, Cameron, et al, go to bed tonight, they will, sadly, not have FTTH anywhere above number 10 in their lists of things to do.

Elsewhere, I really admire the art of the elegantly-timed press release, and this one from Cisco yesterday really seemed to pile on the agony in a masterful way. I'm sure the financial community would love to say something in response, but a naked emperor tends to be silent. I smell an opportunity in the making.

UPDATE: I resisted posting this the first time around, but have thought better of it. Perhaps I was a bit harsh on the Ars Technica article; afterall, it does allude to the distractions of the current crisis. In any event, it's the mention of "ceding leadership to Japan" that actually gets my goat. I speak Japanese, have lived there, and have worked for a number of Japanese companies in my time, and I remain skeptical.

On my last visit, while at Merrill Lynch, in summer 2007, I had lunch with a group of very smart telecom consultants who were very well-connected, particularly to NTT. At one point I mentioned the awe with which the West views Japan's FTTH deployment. They were genuinely baffled. The general comment coming back was, "The only benefit of fiber as far as we can see at this point is in cheaper voice" (the NTT fiber packages have a relatively generous VoIP subscription lumped on top for a fairly nominal fee). I was stunned.

Another moment of epiphany for me occurred while I was still at Daiwa, when I had a meeting request from yet another consultant who had been commissioned by a Japanese government agency to travel the world looking at issues of innovation. His explanation of the rationale behind his brief was that, the agency in question had noticed a marked decline in student intake in computer science programs at Japanese universities, and was appalled. Surely a country with world-beating last mile access should also be taking the lead in application development, where the real long-term value would be created, right? Wrong, apparently, to the dismay of the government agency, which seemed to be terrified of China.

In any event, upon reflection, it occurs to me that FTTH as an enabler of economic opportunity for the individual is naturally likely to be constrained in Japan, which is still rigid in its approach to work and commerce. The country is not geared to accomodate the maverick entrepreneur (Masayoshi Son, a rare exception, is ethnically classified as a Korean-Japanese, therefore an outsider, with a license to be awkward), and work is still largely defined by hours spent in the office as opposed to any other definition. The notion of telecommuting is utterly alien, as far as I know. So, ultimately, technology alone does not transform, at least not in the absence of some other key ingredients which are cultural/economic/political in nature, and much harder to put in place where absent.

Tuesday, September 30, 2008

The new look

After four-plus years using one of Blogger's oldest templates, I have decided to modernize. I must say that the modular layout of the new Blogger is one helluva lot more user-friendly than the old version. I was tempted, however, to go for an "environmentally friendly" black background with white text, though I resisted. Any views out there? Comments are also enabled now, for the first time. Please don't spam me.

Monday, September 29, 2008

Do Hoovervilles have free Wi-fi?

Print it out, put it in your desk drawer, and hope you never see anything like it again. It's a piece of recent history, and not a pretty one at that. At various times today, I was tempted to make a blog post or two about just how bad the market was, but I was, frankly, speechless. $1 trillion wiped off the US stock market, five bailouts/quasi-bailouts (four of them in Europe), and a $700 billion rescue package dead in the water. And tomorrow is another day. My advice, in the words of W.C. Fields, "Start your day with a smile and get it over with."

Tag: Hooverville

Tag: Hooverville

Thursday, September 25, 2008

What do get when you cross a Skype with an Asterisk?

I dunno, but we're soon going to find out! I haven't written about Skype since I don't know when, but this is a really cool announcement, and the kind of thing that should have happened a long time ago. It may not be a sooper-dooper Jabberized Cisco Telepresence/Webex mash-up for enterprise, and that's the point. For the smaller business which would probably never go down that route to begin with, this could be an appealing combination.

A small dose of sanity

Well, despite my fretting, the European Parliament yesterday surprisingly did the sensible thing, and rejected the notion that telcos should be required to police copyright and threaten/disconnect/blacklist file sharers. A lot of people probably will view the results on privacy as less encouraging, and the functional separation result as a halfway house made of fudge. The VON Coalition is also apparently disappointed with the stance towards emergency calling, as it appears that politicians continue to fundamentally misunderstand the technical limitations of VoIP (I would point to their press release but it's not on the site yet).

Wednesday, September 24, 2008

Mean old Cisco

Apologies for the lame "Big Boy" Crudup pun. I spent most of today out and about at meetings, and was offline for a lot of that time. The last press release I saw this morning before I left was the Cisco collaboration salvo, illustrating just the sort of vision which makes last week's Jabber acquisition so intriguing. The first thing I noticed when I got home was that my inbox was flooded with Cisco IOS security alerts - a dozen of them, in fact. I know the company has a policy of batching these on the third Wednesday of each month, but this still seems like a really big concentration. If anyone has any ideas on why this is, and what sort of nastiness has been going on, do let me know.

Tuesday, September 23, 2008

Miracle of the day: Deus ex machina 2.0

Imagine that you are a really important person, let's say, for the sake of argument, the Treasury Secretary of the US. And you've had a really shitty day at work. Not many people like or trust you. You get a lot of bad press. You're probably tempted to just throw in the towel and retreat to a modest 100,000 acre shack somewhere. Then, just when the chips are down at their downermost, at the end of another shocking day in the stock market, out of nowhere, one of the few visible figures within the finance world with any credibility left suddenly steps in to lodge a very public vote of confidence in the now-hollow Bulge Bracket. Amazing. Incredible. Miraculous. It's almost enough to make one believe in some sort of intelligent design theory...

Tags: Woody Guthrie, Frank Zappa

Tags: Woody Guthrie, Frank Zappa

Monday, September 22, 2008

How I spent One Web Day

Happy One Web Day. In case you've never heard of it, this brainchild of Dr. Susan Crawford is an interesting annual collective pause for personal reflection on the importance of the web, how it has transformed our individual lives and society, how it could be better, and also how life would be if we were deprived of it, or if our use of it were hobbled beyond current levels (nice example of the non-informative retrospective press release).

This certainly made an interesting backdrop to my day, as I attended and presented at the Society for Computers and Law event on the topic of "Legislating for Web 2.0". Thanks to my friend Chris Marsden for the invitation - I hope I didn't lower the tone too much. This was a very impressive assemblage of great legal minds from academia, commercial law and regulatory agencies, grappling with the thornier aspects of the package of proposed reforms to the EU framework on electronic communications (good coverage here and here), which will be voted on in the European Parliament in two days' time.

The bad news is that I don't have a lot of time to summarize the day, and worse, I can't make tomorrow's session due to previous commitments. In any event, I don't feel all that comfortable trying to summarize other people's presentations, particularly on the law, in the fear that I will misinterpret/misrepresent points of view and precedents of which I have little or no knowledge. The good news is that, so I am told, mp3 files of all presentations (but not Q&A sessions, which were preserved as a venue for franker exchanges), as well as slide decks and papers (where applicable) will be published on the site shortly after the event. As I won't be attending day two, I can't vouch for any of the content, but from today's presentations I would single out Jon Crowcroft (Cambridge Univ.), Jean-Jacques Sahel (Skype), Monica Ariño (OFCOM), Jonathan Cave (Warwick Univ.), and Viktor Mayer-Schönberger (LKY School of Public Policy, Singapore) as particularly interesting. In any event, when all the presentations become available, I would heartily encourage you all to delve in...

Having excused myself from the burden of trying to represent other people's points of view, I can focus on some general observations, and my own participation. At a high level, despite a wide range of viewpoints on the key issues, I think there were some interesting points of widespread (but not universal) agreement:

In this presentation, unlike some previous cases, I actually found myself defending the telecom industry, which probably makes a first. This stems from the fact that I was attempting to view the situation entirely through the lens of a dispassionate investor, wherein I tried to stress that good investors would, on balance, likely embrace a non-ideological, non-dogmatic point of view, and probably come to the conclusion that it is economically unacceptable for a much smaller industry largely bankrupt of ideas (traditional content) to outsource its enforcement processes (and the accompanying costs and liabilities) to telcos and ISPs, at least on the basis of legal obligations. If telcos want to engage in voluntary bilateral agreements with content owners to do the same, that is a commercial consideration, and the market (where it actually functions properly) has mechanisms to respond to this scenario. I personally wouldn't be particularly happy with this outcome either, but at least it would be a market-driven solution rather than one mandated by a centralized regulatory authority. In other words, I prefer suicide to murder...

However, if we're looking at legally mandated measures, then I am very skeptical about their efficacy, due to the asymmetry between geeks and industry/regulators - more often known as the cat-and-mouse game. For example, I mention in my presentation the current growth in the number of BitTorrent proxy services, the most interesting of which, for my money, is Instant Torrents. The service itself is free, but the user has to pay for the associated VPN service, to safeguard anonymity (and a revenue stream for the operators). The message here is that, while telcos are focusing on (and in many cases, investing in appliances to monitor/throttle) BitTorrent, the geeks are already at least one step ahead (providing encrypted HTTP traffic for the masses) - as if this should be a surprise. Moreover, the geeks are actually monetizing a market niche which itself would not exist if not for the efforts of the content industry to emphasize control rather than innovation - via coercing telcos to intervene on its behalf.

Beyond this viewpoint, I stressed the idea that, once a Pandora's Box of legal remedies is opened, we might find huge inconsistencies inside. For example, the content industry focus on throttling/inspecting file-sharing protocols, the failings of which I allude to above, also seems to fail to capture alternative approaches, such as file transfer via IM/Skype (the latter of which is of course inherently encrypted, due to the fundamental design of the application), Mojo, or a USB stick-based revival of the Sneakernet. My question to the audience in the Q&A was to what extreme do we want to take this exercise before we give up?

As a closing point, seeking to illustrate the potential pitfalls of legislation in this area, I suggested that perhaps the current approach should be extended to other industries which also unknowingly enable file-sharing, but which so far have been excluded from the policy debate. For example, we obviously need electricity to power computers, so why not require electricity companies to identify what part of the consumer's power consumption is related to copyright violation or other pernicious uses, and a method to punish consumers accordingly? Similarly, perhaps computer retailers should be required to make buyers of computers sit through a 30-minute indoctrination session, followed by a signed declaration of hostility towards violation of IPR. These are absurd arguments, of course, but in my view hardly more absurd than what the EU may enact in a couple of days.

This certainly made an interesting backdrop to my day, as I attended and presented at the Society for Computers and Law event on the topic of "Legislating for Web 2.0". Thanks to my friend Chris Marsden for the invitation - I hope I didn't lower the tone too much. This was a very impressive assemblage of great legal minds from academia, commercial law and regulatory agencies, grappling with the thornier aspects of the package of proposed reforms to the EU framework on electronic communications (good coverage here and here), which will be voted on in the European Parliament in two days' time.

The bad news is that I don't have a lot of time to summarize the day, and worse, I can't make tomorrow's session due to previous commitments. In any event, I don't feel all that comfortable trying to summarize other people's presentations, particularly on the law, in the fear that I will misinterpret/misrepresent points of view and precedents of which I have little or no knowledge. The good news is that, so I am told, mp3 files of all presentations (but not Q&A sessions, which were preserved as a venue for franker exchanges), as well as slide decks and papers (where applicable) will be published on the site shortly after the event. As I won't be attending day two, I can't vouch for any of the content, but from today's presentations I would single out Jon Crowcroft (Cambridge Univ.), Jean-Jacques Sahel (Skype), Monica Ariño (OFCOM), Jonathan Cave (Warwick Univ.), and Viktor Mayer-Schönberger (LKY School of Public Policy, Singapore) as particularly interesting. In any event, when all the presentations become available, I would heartily encourage you all to delve in...

Having excused myself from the burden of trying to represent other people's points of view, I can focus on some general observations, and my own participation. At a high level, despite a wide range of viewpoints on the key issues, I think there were some interesting points of widespread (but not universal) agreement:

- EU regulation, while driven at a high level by Brussels, is in practice codified and enforced at national level by the NRAs, who individually face a wide array of challenges vis-a-vis mandate, scope, structure, funding, resourcing, and cognitive dissonance;

- There is a fairly widely-voiced concern that technological and consumer behavioral change is well ahead of the regulators' learning curves, and that (largely related to resourcing issues cited in point 1), regulators are, for the most part, poorly equipped to respond to these changes in a way that ensures a considered approach to variables which are, frankly, unpredictable;

- There seems to be a fair amount of trepidation and bafflement surrounding the relatively late appearance in the language of the 2008 draft package elements relating to copyright enforcement and the role of telcos in this;

- There seems to be a depressingly low level of awareness/discussion/debate in "general society" about the proposed changes, outside the circles of interested parties likely to be affected.

In this presentation, unlike some previous cases, I actually found myself defending the telecom industry, which probably makes a first. This stems from the fact that I was attempting to view the situation entirely through the lens of a dispassionate investor, wherein I tried to stress that good investors would, on balance, likely embrace a non-ideological, non-dogmatic point of view, and probably come to the conclusion that it is economically unacceptable for a much smaller industry largely bankrupt of ideas (traditional content) to outsource its enforcement processes (and the accompanying costs and liabilities) to telcos and ISPs, at least on the basis of legal obligations. If telcos want to engage in voluntary bilateral agreements with content owners to do the same, that is a commercial consideration, and the market (where it actually functions properly) has mechanisms to respond to this scenario. I personally wouldn't be particularly happy with this outcome either, but at least it would be a market-driven solution rather than one mandated by a centralized regulatory authority. In other words, I prefer suicide to murder...

However, if we're looking at legally mandated measures, then I am very skeptical about their efficacy, due to the asymmetry between geeks and industry/regulators - more often known as the cat-and-mouse game. For example, I mention in my presentation the current growth in the number of BitTorrent proxy services, the most interesting of which, for my money, is Instant Torrents. The service itself is free, but the user has to pay for the associated VPN service, to safeguard anonymity (and a revenue stream for the operators). The message here is that, while telcos are focusing on (and in many cases, investing in appliances to monitor/throttle) BitTorrent, the geeks are already at least one step ahead (providing encrypted HTTP traffic for the masses) - as if this should be a surprise. Moreover, the geeks are actually monetizing a market niche which itself would not exist if not for the efforts of the content industry to emphasize control rather than innovation - via coercing telcos to intervene on its behalf.

Beyond this viewpoint, I stressed the idea that, once a Pandora's Box of legal remedies is opened, we might find huge inconsistencies inside. For example, the content industry focus on throttling/inspecting file-sharing protocols, the failings of which I allude to above, also seems to fail to capture alternative approaches, such as file transfer via IM/Skype (the latter of which is of course inherently encrypted, due to the fundamental design of the application), Mojo, or a USB stick-based revival of the Sneakernet. My question to the audience in the Q&A was to what extreme do we want to take this exercise before we give up?

As a closing point, seeking to illustrate the potential pitfalls of legislation in this area, I suggested that perhaps the current approach should be extended to other industries which also unknowingly enable file-sharing, but which so far have been excluded from the policy debate. For example, we obviously need electricity to power computers, so why not require electricity companies to identify what part of the consumer's power consumption is related to copyright violation or other pernicious uses, and a method to punish consumers accordingly? Similarly, perhaps computer retailers should be required to make buyers of computers sit through a 30-minute indoctrination session, followed by a signed declaration of hostility towards violation of IPR. These are absurd arguments, of course, but in my view hardly more absurd than what the EU may enact in a couple of days.

Friday, September 19, 2008

Happy Friday

Hooray, everything's going to be fine! The US taxpayer will ride to the rescue, and those mean old short sellers have been given a good telling off, like the naughty boys they are. So there. Glad we fixed those two problems - that's what regulators are for, afterall.

In conversation with a fiber specialist today, we stumbled upon a great new technical innovation: make fiber networks entirely green by powering all the electronics with former structured finance bankers, SEC apparatchiks, and CDO analysts from the ratings agencies on one of these - until they're reeeaaally sorry.

Elsewhere, I noted with interest Cisco's acquisition of Jabber, which I think is a very, very smart move. I do wonder how you take a company with such a developer-driven community around it and harness it to a big company like Cisco, but if they can manage it properly without alienating anyone, it should be an invaluable asset.

In conversation with a fiber specialist today, we stumbled upon a great new technical innovation: make fiber networks entirely green by powering all the electronics with former structured finance bankers, SEC apparatchiks, and CDO analysts from the ratings agencies on one of these - until they're reeeaaally sorry.

Elsewhere, I noted with interest Cisco's acquisition of Jabber, which I think is a very, very smart move. I do wonder how you take a company with such a developer-driven community around it and harness it to a big company like Cisco, but if they can manage it properly without alienating anyone, it should be an invaluable asset.

Thursday, September 18, 2008

Sobering chart of the day

Okay, I really mean it, this is not transforming into a financial blog, but I have for many years been interested in technical analysis. I don't consider myself to be a technical analyst, but I had the good fortune early in my financial career to spend a lot of time with a talented technical trader, who got me hooked (Paul, if you're out there, let me hear from you - I'd love to have your take on the current situation).

Anyway, this is a Fibonacci graph of the S&P 500 on a weekly basis from January 1970 up to last Friday. For those unfamiliar, a Fibonacci graph uses the Fibonacci fractal sequence to plot levels of technical support and resistance.

To me this is a fairly frightening picture. Firstly, it's interesting to note that (in relative historical terms) the market was basically range-bound during the 1970s, followed by a relatively gradual run-up in the '80's and early '90's. From 1995, we pretty much know the story, chapter and verse, yet it's quite extraordinary how "supersized" the quantum gets after that point to the crash of March 2000. I would be interested to see this plotted against the growth in consumer and corporate leverage over the same period, but I don't have those tools at this point. It's nevertheless interesting to note that, as bad as things seem now, we're less than halfway through the peak/trough range of the dotbomb bear market (and the peaks are disconcertingly similar, possibly qualifying as a double-top) - and let's be honest, the situation this time around is potentially much, much more serious, with more widespread ramifications, and the wildcards of globalization and climate change thrown in just for fun.

Anyway, this is a Fibonacci graph of the S&P 500 on a weekly basis from January 1970 up to last Friday. For those unfamiliar, a Fibonacci graph uses the Fibonacci fractal sequence to plot levels of technical support and resistance.

To me this is a fairly frightening picture. Firstly, it's interesting to note that (in relative historical terms) the market was basically range-bound during the 1970s, followed by a relatively gradual run-up in the '80's and early '90's. From 1995, we pretty much know the story, chapter and verse, yet it's quite extraordinary how "supersized" the quantum gets after that point to the crash of March 2000. I would be interested to see this plotted against the growth in consumer and corporate leverage over the same period, but I don't have those tools at this point. It's nevertheless interesting to note that, as bad as things seem now, we're less than halfway through the peak/trough range of the dotbomb bear market (and the peaks are disconcertingly similar, possibly qualifying as a double-top) - and let's be honest, the situation this time around is potentially much, much more serious, with more widespread ramifications, and the wildcards of globalization and climate change thrown in just for fun.

Ugly chart of the day: Morgan Stanley

I promise this is not turning into a financial blog, but I have experienced in my career four events which I would classify as significant market corrections, and I have never seen anything like what is happening now. Today's horror story is Morgan Stanley's share price graph, grabbed a few minutes ago. I think this is what they call "conviction selling." For those unfamiliar with technicals, this is a candlestick chart, and the candlesticks at the top are the intra-day trading range of the stock, bars at the bottom are volume. What is striking, apart from the sheer magnitude of the drop, is the huge price swings in the last couple of sessions, and also the volume. It's not total capitulation, but it's damned close.

UPDATE at 10:50 PM London: MS has staged a late rally back into positive territory, which is of course great news, but I wonder what underpins it. Funds refusing to lend stock to shorts, rumors of rescue packages, etc. - maybe positive for the firm specifically, but do these really alter the fundamental landscape? I would say no.

UPDATE at 10:50 PM London: MS has staged a late rally back into positive territory, which is of course great news, but I wonder what underpins it. Funds refusing to lend stock to shorts, rumors of rescue packages, etc. - maybe positive for the firm specifically, but do these really alter the fundamental landscape? I would say no.

Imax sized iPhone

How cool would this have been if they'd set this up to actually display a (moderated) stream of photos taken with iPhones all over the world, akin to Flickr's "Everyone's Photos" RSS feed? That would have been both HUGE and interesting... (FYI, this is the Imax cinema near Waterloo Station, and the entire facade of the building is wrapped in iPhone/O2 advertising.)

Appeal for help

Monday after the TEN panel which I chaired, a couple of sell-side analysts, whose names I knew but had never met, approached me for a chat (nice to meet you guys, and thanks for the support). One of them stated that he thought this blog was quite widely read by analysts on the buy-side, which was news to me. I monitor my traffic with interest, but this only offers limited insight into readers' identities. In any event, if you are on the buy-side, covering or investing in telecoms (credit or equity), I'd like to ask for your assistance in a research project I'm working on at the moment. It would involve either a chat on the phone to cover a few questions, or responding to a few questions via email. All responses will be treated with complete discretion and confidentiality, though you may end up being quoted or paraphrased anonymously. Ping me here if you're interested.

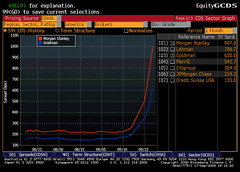

Ugly Chart of the Day: And Then There Were Two

CDS spreads on Goldman Sachs and Morgan Stanley. Goldman at 620 over on CDS, and equity down 14% at today's close (having been down much more earlier in the session), both absolutely unthinkable a year ago (some would say it couldn't happen to a nicer group of people). Morgan Stanley (which is apparently talking to Wachovia and HSBC) at an even more unthinkable 998 over on CDS (i.e., roughly in line with a typical distressed cable/altnet company), with equity down 24% today. Double ouch...

Wednesday, September 17, 2008

Ouch of the day: One Lilliputian Liverpudlian family wanted

This story isn't very good press for English builders. Bring on the Olympics!

Via a charter Palladium Club mega-uber value reader.

Via a charter Palladium Club mega-uber value reader.

Tuesday, September 16, 2008

From the ashes of disaster...

The U.S. government has clarified its stance on "moral hazard" by allowing a major investment bank to fail. The International Swaps and Derivatives Association is so focused on orchestrating an orderly unwind of Lehman's positions that it held a special trading session on Sunday and has even canceled its own members conference, which should have taken place today (perhaps they were afraid that the offer of a free lunch might trigger a riot).

AIG now appears to be on its knees, and apart from the human consequences for its 100,000 employees and consumers of its more conventional insurance and re-insurance products, its demise would make the credit derivatives market significantly more complicated. Sparing readers the tedious technical details, this is significant because: a) the market is huge - Moody's estimated credit default swaps at $62 trillion back in May (that's the nominal, but replacement cost, which they think is more relevant, was a mere $2 trillion - in any event, as CDS has evolved to be a speculative trading, rather than commercial hedging, instrument, the contracts outstanding outstrip the underlying assets many times over, which may bring some problems of its own in time), and b) transactions are off-market, with limited visibility as to who's doing what, and with whom. So it's only when the music stops that we learn which counterparties are exposed, and I assume an AIG implosion would cascade through similarly positioned insurers, hedge funds, and the remaining prop desks in a very ugly fashion.

We're now more than $500bn down the road in the inappropriately named "credit crunch." I say inappropriately named because, to me, "crunch" implies a sharp, ephemeral episode of pain or distress, but this is more akin to a pandemic wasting disease, and I think it represents a fundamental realignment of the way capital will be sourced and allocated in future. Why should the denizens of Telcoland care? Well, because, as with most crises, there will be huge challenges and opportunities ahead.

First, the challenges.

1) Confidence, be it within the corporates (as we can see in the spike in inter-bank lending rates) or among consumers, is firmly in the toilet, ready to be flushed. Prepare for an aversion to spending, and for some of your customers to disappear.

2) Liquidity, where it exists at all, is going to be more scarce and costly. Given where LIBOR is at the moment, this could get very ugly indeed - in desperate cases, say where the margin over LIBOR is 1000 basis points or more, companies will be staring down the barrel of 17% annual interest rates. For the more creditworthy, things won't be so dire, but it still will be a noticeable uptick. I trawled quickly through some Bloomberg data on debt maturities for six telcos (Vodafone, DT, FT, Telefonica, BT, and Telecom Italia), and it is interesting to note that the average fixed coupon for this group's current debt is just over 6%, i.e., below the level where banks are currently willing to lend to one another, let alone anyone else. However, these six companies combined have EUR37.5bn in debt maturing in 2009 - 10. It will get refinanced, but every 100 basis point increment above where coupons are now adds EUR375m in interest payments. Not crippling, but not trivial either. Do you grow dividends at the expense of capex?

3) Speaking of capex, a friend earlier today described it as the elephant in the room. If we assume that the industry globally needs a $1 trillion access overhaul, as some are already under competitive pressure to provide, then something's got to give. Do you play "squeeze the vendor" as your only card, defer certain projects, or find creative alternative structures to keep it off your balance sheet in the near term? Do you suddenly find that the municipal broadband "hippies" are worth talking to afterall? Some of them might have access to cheaper finance...

4) Back to liquidity more generally. It seems clear that those investment banks which do survive are likely to be constrained by commercial and financial realities, and possibly by regulation, to a narrower mandate in future. So those with a business falling outside the "suitable for widows and orphans" category probably won't be able to reach out to the principal investing units of Wall Street nearly as easily as they could before. Hedge funds with dry powder can always fill that gap, I suppose, but it won't be cheap money. And the hedge funds themselves aren't exactly setting the world on fire as a group (keep in mind that this table may look different depending on when you read it, but at this writing, the Credit Suisse/Tremont AllHedge Index is down 6.07% year-to-date as of the week ending 8th September, i.e., before the most recent round of carnage). There's always private equity, but as I pointed out yesterday, we might actually find a bias towards disposal of assets here in some cases, and in any event, with the markets in the state they're in currently, it is inconceivable that PE firms will achieve the kind of exit IRRs they might have envisaged two or three years back (I'm thinking here of some of the European cable deals which got done at eye-watering multiples - in some cases they're very decent companies, but I can't see an easy exit for any of them.). And it's probably really bad if you're an early-stage company. Everything I hear tells me that there is not that much happening in early stage among the VC community, particularly in Europe, and those who are active can be extremely selective. I expect a good number of the later-stage venture-backed companies may also struggle to attract fresh capital, especially if their funding is premised upon the promise of a traditional exit. It ain't gonna happen, at least not at 10x revenues, unless you've got something really special. I should think that the outlook is particularly poor for companies created to speculatively build large communities, in the hope of finding a revenue model down the road. Don't get me wrong, I love the value and benefit that these sites bring, but in a time of severe capital constraints, it's going to be a hard story to sell. That pretty much leaves sovereign wealth funds (I don't know about the IMF, but I think $3 trillion is a lot of money) and family offices, but they will know that they are in the driver's seat and can be highly selective.

Okay, I think that's a sufficient dose of pain on the challenges side. What about the opportunities? I know times also seem hard in Telcoland, but let's face it, your margins are still at a level other industries would kill for, and it is not uncommon for even relatively small companies to produce EUR2 - 3bn in free cash flow annually. In the land of the broke, the man with one euro is king, so how might you deploy some of your relative wealth in a way that might really make a difference?

1) People - The collective stupidity of Wall Street should not obscure the real talent and intellect that rests with some of its individuals. As these firms implode, they will release some very bright people, some of whom have an intimate knowledge of their own industry and industries they have covered/invested in/done business with. Take this chance to diversify your telco DNA, particularly if you really have aspirations of competing with the likes of IBM.

2) Assets - Clearly, there is going to be a lot of distressed selling of assets. Fancy a Bulgarian incumbent or a Dutch cable company? I might just have the deal for you. But it won't just be big iron assets. As I pointed out earlier, I think a lot of venture-backed companies are going to end up in distress, and some of them may possess technology platforms and/or communities that you as a telco actually can monetize. However, you may need an outside perspective to do this (going back to my previous point), or you may need to radically change the way you think about where to take your business and how to get there. There will be huge opportunities, but it will require something other than conventional telco thinking, because the best answers will not be the obvious ones.

3) Engagement - Rather than simply waiting for companies to end up here before acting, why not partially fill the void left by the capital markets? I'm not suggesting that telcos should play the pure VC role, but I do think there is a great case for aligning strategic development goals with equity investment in companies that have something you can't (or don't want to) create yourself. There is some of this going on in the industry, but not nearly enough, in my view. Some of the companies which can help you reposition yourself are too small and young to be considered as suppliers - they typically can't get in the door of corporate HQ. What might you be overlooking? Encourage your workforce and your customers to find and evangelize interesting companies, and create a framework for vetting them, finding operational sponsorship for the suitable ones, and create a side-pocket for equity investments to let them develop.

All the evidence suggests that we're all in for a fairly brutal couple of years, with the possible exception of talented distressed investors. Next spring may be short on roses (lyrics here), but they will come in time. Now go and start planting your garden.

UPDATE 17 Sept.: Since posting this, AIG has been effectively nationalized, bringing us back from the brink temporarily. However, that this was the final outcome is a symptom of just how dire things are, and does not fundamentally change the dynamic in the market, in my view. We dodged a bullet this time, but there will be more similar situations which do end badly, and my central thesis still holds.

AIG now appears to be on its knees, and apart from the human consequences for its 100,000 employees and consumers of its more conventional insurance and re-insurance products, its demise would make the credit derivatives market significantly more complicated. Sparing readers the tedious technical details, this is significant because: a) the market is huge - Moody's estimated credit default swaps at $62 trillion back in May (that's the nominal, but replacement cost, which they think is more relevant, was a mere $2 trillion - in any event, as CDS has evolved to be a speculative trading, rather than commercial hedging, instrument, the contracts outstanding outstrip the underlying assets many times over, which may bring some problems of its own in time), and b) transactions are off-market, with limited visibility as to who's doing what, and with whom. So it's only when the music stops that we learn which counterparties are exposed, and I assume an AIG implosion would cascade through similarly positioned insurers, hedge funds, and the remaining prop desks in a very ugly fashion.

We're now more than $500bn down the road in the inappropriately named "credit crunch." I say inappropriately named because, to me, "crunch" implies a sharp, ephemeral episode of pain or distress, but this is more akin to a pandemic wasting disease, and I think it represents a fundamental realignment of the way capital will be sourced and allocated in future. Why should the denizens of Telcoland care? Well, because, as with most crises, there will be huge challenges and opportunities ahead.

First, the challenges.

1) Confidence, be it within the corporates (as we can see in the spike in inter-bank lending rates) or among consumers, is firmly in the toilet, ready to be flushed. Prepare for an aversion to spending, and for some of your customers to disappear.

2) Liquidity, where it exists at all, is going to be more scarce and costly. Given where LIBOR is at the moment, this could get very ugly indeed - in desperate cases, say where the margin over LIBOR is 1000 basis points or more, companies will be staring down the barrel of 17% annual interest rates. For the more creditworthy, things won't be so dire, but it still will be a noticeable uptick. I trawled quickly through some Bloomberg data on debt maturities for six telcos (Vodafone, DT, FT, Telefonica, BT, and Telecom Italia), and it is interesting to note that the average fixed coupon for this group's current debt is just over 6%, i.e., below the level where banks are currently willing to lend to one another, let alone anyone else. However, these six companies combined have EUR37.5bn in debt maturing in 2009 - 10. It will get refinanced, but every 100 basis point increment above where coupons are now adds EUR375m in interest payments. Not crippling, but not trivial either. Do you grow dividends at the expense of capex?

3) Speaking of capex, a friend earlier today described it as the elephant in the room. If we assume that the industry globally needs a $1 trillion access overhaul, as some are already under competitive pressure to provide, then something's got to give. Do you play "squeeze the vendor" as your only card, defer certain projects, or find creative alternative structures to keep it off your balance sheet in the near term? Do you suddenly find that the municipal broadband "hippies" are worth talking to afterall? Some of them might have access to cheaper finance...

4) Back to liquidity more generally. It seems clear that those investment banks which do survive are likely to be constrained by commercial and financial realities, and possibly by regulation, to a narrower mandate in future. So those with a business falling outside the "suitable for widows and orphans" category probably won't be able to reach out to the principal investing units of Wall Street nearly as easily as they could before. Hedge funds with dry powder can always fill that gap, I suppose, but it won't be cheap money. And the hedge funds themselves aren't exactly setting the world on fire as a group (keep in mind that this table may look different depending on when you read it, but at this writing, the Credit Suisse/Tremont AllHedge Index is down 6.07% year-to-date as of the week ending 8th September, i.e., before the most recent round of carnage). There's always private equity, but as I pointed out yesterday, we might actually find a bias towards disposal of assets here in some cases, and in any event, with the markets in the state they're in currently, it is inconceivable that PE firms will achieve the kind of exit IRRs they might have envisaged two or three years back (I'm thinking here of some of the European cable deals which got done at eye-watering multiples - in some cases they're very decent companies, but I can't see an easy exit for any of them.). And it's probably really bad if you're an early-stage company. Everything I hear tells me that there is not that much happening in early stage among the VC community, particularly in Europe, and those who are active can be extremely selective. I expect a good number of the later-stage venture-backed companies may also struggle to attract fresh capital, especially if their funding is premised upon the promise of a traditional exit. It ain't gonna happen, at least not at 10x revenues, unless you've got something really special. I should think that the outlook is particularly poor for companies created to speculatively build large communities, in the hope of finding a revenue model down the road. Don't get me wrong, I love the value and benefit that these sites bring, but in a time of severe capital constraints, it's going to be a hard story to sell. That pretty much leaves sovereign wealth funds (I don't know about the IMF, but I think $3 trillion is a lot of money) and family offices, but they will know that they are in the driver's seat and can be highly selective.

Okay, I think that's a sufficient dose of pain on the challenges side. What about the opportunities? I know times also seem hard in Telcoland, but let's face it, your margins are still at a level other industries would kill for, and it is not uncommon for even relatively small companies to produce EUR2 - 3bn in free cash flow annually. In the land of the broke, the man with one euro is king, so how might you deploy some of your relative wealth in a way that might really make a difference?

1) People - The collective stupidity of Wall Street should not obscure the real talent and intellect that rests with some of its individuals. As these firms implode, they will release some very bright people, some of whom have an intimate knowledge of their own industry and industries they have covered/invested in/done business with. Take this chance to diversify your telco DNA, particularly if you really have aspirations of competing with the likes of IBM.

2) Assets - Clearly, there is going to be a lot of distressed selling of assets. Fancy a Bulgarian incumbent or a Dutch cable company? I might just have the deal for you. But it won't just be big iron assets. As I pointed out earlier, I think a lot of venture-backed companies are going to end up in distress, and some of them may possess technology platforms and/or communities that you as a telco actually can monetize. However, you may need an outside perspective to do this (going back to my previous point), or you may need to radically change the way you think about where to take your business and how to get there. There will be huge opportunities, but it will require something other than conventional telco thinking, because the best answers will not be the obvious ones.

3) Engagement - Rather than simply waiting for companies to end up here before acting, why not partially fill the void left by the capital markets? I'm not suggesting that telcos should play the pure VC role, but I do think there is a great case for aligning strategic development goals with equity investment in companies that have something you can't (or don't want to) create yourself. There is some of this going on in the industry, but not nearly enough, in my view. Some of the companies which can help you reposition yourself are too small and young to be considered as suppliers - they typically can't get in the door of corporate HQ. What might you be overlooking? Encourage your workforce and your customers to find and evangelize interesting companies, and create a framework for vetting them, finding operational sponsorship for the suitable ones, and create a side-pocket for equity investments to let them develop.

All the evidence suggests that we're all in for a fairly brutal couple of years, with the possible exception of talented distressed investors. Next spring may be short on roses (lyrics here), but they will come in time. Now go and start planting your garden.

UPDATE 17 Sept.: Since posting this, AIG has been effectively nationalized, bringing us back from the brink temporarily. However, that this was the final outcome is a symptom of just how dire things are, and does not fundamentally change the dynamic in the market, in my view. We dodged a bullet this time, but there will be more similar situations which do end badly, and my central thesis still holds.

Thanks Dave!

Dave Burstein at the ever-excellent DSLPrime has name-checked me very kindly in his most recent edition published today. I am truly humbled.

Monday, September 15, 2008

One used incumbent, anyone?

All those who predicted the end of the world last week with the commissioning of the LHC at Cern, were wrong. As we can see, the world will be ending this week, and it's only Monday. From a telco perspective, I'm curious as to whether BTC ends up in the AIG firesale. I looked very closely at the debt syndication late last year, which of course ended up as a busted deal due to the state of the market. It wasn't particularly appealing at the time, but I assume some telco buyers may now be willing to try a lowball bid and take advantage of AIG's distress.

UPDATE: I would also expect to find some bargains among the Lehman VC investments.

UPDATE: I would also expect to find some bargains among the Lehman VC investments.

Hitting back

UPC is answering the FTTH challenge in the Netherlands, with a DOCSIS 3.0 deployment promising 120Mbps and branded "Fiber Power 120." Don't get me wrong, stuck here in the land of Access 1.0, I wouldn't turn it down, but how can it compete with GigE to the home, particularly if KPN ends up in the driving seat at Reggefiber? Plus, it's still a hugely asymmetrical service, which might turn off power users. Then again, as Vincent Dekker points out (welcome to the blogosphere!), in the short term, this really is the final nail in KPN's FTTC plans (appalling translation here). An interesting inclusion in Vincent's post, but omitted from the press release, is that the first deployments will be in Amsterdam and Almere, places where Reggefiber's investment has so far been concentrated. It looks like in this case the market genuinely will drive investment towards full-blown FTTH, at least on a highly localized basis - a dynamic I look forward to seeing in other cases where incumbents have opted for FTTC.

Sunday, September 14, 2008

The other (r)evolution

In all the hoopla and anti-hoopla surrounding last week's BSG report release, the cost analysis of which featured prominently in the Caio report, I didn't see much representation in the blog world from those on the sharp end of the "access divide" (I prefer this to "digital divide" in this case) - that is, until now. This is a good, passionate post, and I think it raises a number of valid criticisms. Most importantly, it is written from the perspective of someone actually living the broadband nightmare which many of us are lucky enough to have avoided.

Friday, September 12, 2008

You've been noticed, and that's good!

Occasionally, covering this space, one comes across something which brings about an unsolicited flood of mean-spirited surrealistic thoughts. Such is the case with the upcoming CCF European Call Centre Awards 2008. Imagine an event organized by, and for, the industry which invariably makes the lives of ordinary people a journey to the innermost circle of hell. What could we envisage if such quaint concepts as karma actually held true in the real world?

Presenter: "It's my pleasure to award Company X 2008 call centre operator of the year! But before I can complete the award, I just need to confirm your full name, the first line of your address and your memorable security word... Thank you, let me now pass you to my colleagues in Awards Distribution, please hold - this will cost you 35p per minute..."

[Muzak]

Awards Distribution department: "Thank you for holding, may I please have your your full name, the first line of your address and your memorable security word? I'm sorry, the system's gone down, can I please ask you to come back to the podium later?"

Okay, admittedly that's a cheap shot at a difficult industry, but nevertheless one which, time and again, proves to be a costly and frustrating Achilles heel for telcos (or substitute the consumer-facing industry of your choosing), and a hideous and alienating experience for consumers. It may be deeply unsexy to the outsider, but the potential for transformation is huge, and deeply sexy in financial terms.

It turns out that my good friends at VoiceSage in Ireland have ended up as finalists in the category "Best Product at Call Centre Expo," which I'm very sure they deserve. However, I think it's shortsighted to pigeon-hole this company in the call centre space, as their thinking goes way outside the conventional box (please see Paul Sweeney's very interesting blog for more insight into what goes on under the hood), and is based much more around the concept of addressing customer psychology and transforming business processes.

Well done guys, and best of luck next Tuesday!

Presenter: "It's my pleasure to award Company X 2008 call centre operator of the year! But before I can complete the award, I just need to confirm your full name, the first line of your address and your memorable security word... Thank you, let me now pass you to my colleagues in Awards Distribution, please hold - this will cost you 35p per minute..."

[Muzak]

Awards Distribution department: "Thank you for holding, may I please have your your full name, the first line of your address and your memorable security word? I'm sorry, the system's gone down, can I please ask you to come back to the podium later?"

Okay, admittedly that's a cheap shot at a difficult industry, but nevertheless one which, time and again, proves to be a costly and frustrating Achilles heel for telcos (or substitute the consumer-facing industry of your choosing), and a hideous and alienating experience for consumers. It may be deeply unsexy to the outsider, but the potential for transformation is huge, and deeply sexy in financial terms.

It turns out that my good friends at VoiceSage in Ireland have ended up as finalists in the category "Best Product at Call Centre Expo," which I'm very sure they deserve. However, I think it's shortsighted to pigeon-hole this company in the call centre space, as their thinking goes way outside the conventional box (please see Paul Sweeney's very interesting blog for more insight into what goes on under the hood), and is based much more around the concept of addressing customer psychology and transforming business processes.

Well done guys, and best of luck next Tuesday!

Tuesday, September 09, 2008

Shameless self-promotion 3.1

I'm very happy to have been asked to speak at the upcoming Society for Computers and Law event - Legislating for Web 2.0 - Preparing for the Communications Act? - which will take place on 22nd/23rd September in London. Apart from me, it's a very impressive list of speakers, and damned good value at only £600 for both days for non-members - at the current rate of Sterling devaluation, that should be something like EUR50 by the actual date ;-(... Organizer/curator/ringmaster Chris Marsden, who has craftily already taken the best title in the event, "May the Phorm be With You," has placed me in the first panel, which is either a blessing or a curse, I'm still not sure. In any event, I hope to see you there.

Misery loves company

So the old adage goes, but I'm thinking more of this sort of misery, or perhaps the Amityville Horror with a spin (instead of "For God's sake, get out!" it would be "Fix my broadband first for God's sake, then - but only then - get out!"). This is an amazing story, and one the telecom industry should perversely be proud of. You've achieved something which only a handful of industries (electricity, gas, water, food, tobacco, alcohol, gambling) have cracked - creating a product that customers consider absolutely indispensible once it's embedded in their lives (note that the poor unhinged customer in question had a huge backlog of work to deal with, and her career is clearly deeply dependent on working from home). They almost certainly don't love you, but you don't have to give them reasons to hate you.

Via the excellent Hermes Project

Via the excellent Hermes Project

More Chrome trivia

Google Analytics is now showing Chrome at 7.8% of my site traffic from yesterday, for what it's worth.

The state we're in

It's time for another installment in Akamai's ongoing series of quarterly reports on the state of the internet, catchily entitled, "The State of the Internet" (registration required, but it's worth it). It's the usual compendium of DNS hijacks, DDOS attacks, site hacks and other web nightmares, with a lot of connectivity data by country as well. Standouts which surprised me were that Japan tops the list of countries of origin for attacks this time (もーれつ!), and that Akamai's analysis seems to show no obvious correlation between percentage of high bandwidth users (defined as >5Mbps) and proportion of attacks. Most appalling to me, as a (lapsed) American is the revelation that 16% of internet users seen by Akamai in Washington D.C. appeared to have access speeds below 256k, i.e., on a par with Malaysia and a few points worse than Colombia. In an election year where the internet has proven to be such a powerful tool, to have nearly a fifth of people in the capitol of the world's (currently) most influential nation muddling through with glorified dial-up speeds (regardless of what the FCC says) is/should be the source of a profound sense of shame.

Monday, September 08, 2008

Chrome trivia

As you may be aware, Google Analytics breaks out Google's own newly-released Chrome browser (in case you have been on another planet for the past week) in its breakdown of visitor browsers. Two days ago Chrome accounted for 1.5% of my site traffic, and today it is over 3%. I don't know how representative my readership is of internet users generally, but the quantum of the growth is quite interesting to me, especially considering that Safari is consistently in the 6 - 7% range. I'm intrigued to see how this trend develops.

New BSG report on costs of fiber deployments

The UK Broadband Stakeholder Group (BSG) has just this morning released a report from Analysys Mason on the likely costs of fiber access in the UK. I've only had a chance to read the summary conclusions so far, but it all seems pretty consistent with what we've seen elsewhere:

More comments as I wade through this beast.

UPDATE: Very interesting "geotype"-based cost analysis contained here, which seems to bear out what I've heard anecdotally from a number of people actively involved in fiber deployments - namely that the cost differential between PON and P2P is on the order of only 10 - 15%, at least in high density areas. That's the good news. The bad news is that someone is going to have to come up with £25 - 30bn for universal national PON/P2P coverage - that's the equivalent of 8 - 10 years of capex for BT at the current run-rate. On the positive side, 2/3 of the country could be covered for a more modest £10 - 12bn (for perspective, BT's market cap is currently £13.5bn). Obviously, FTTC/VDSL is dramatically cheaper, apparently allowing coverage of 60% of the country for £2bn, which puts it within BT's capex envelope and unsurprisingly is the direction the company has taken so far.

For the remaining 1/3 of the country which I assume will be left out in the near term, in more normal economic conditions, I would assume that local initiatives and entrepreneurial capital could fill the gaps (we have seen it before and there are other examples taking shape elsewhere) to some extent, but I'm struggling to see that happening in the UK in the current climate. Nor do I envisage much political vision given the current Punch-n-Judy state of UK politics. My initial sense is that, in the absence of the kind of partial mutualization of infrastructure between BT and Virgin envisaged as one scenario in the report, what we are likely to end up with for the foreseeable future is an urban-focused battle between FTTC and DOCSIS 3.0, with BT opportunistically cherry-picking desirable areas with FTTH, and Virgin, carrying four turns of leverage, having not a lot of scope to respond. I hope I'm wrong...

- FTTC is likely to dominate at least initially

- FTTH will initially probably only be deployed in areas of new build

- infrastructure sharing with other utilities (ahem) may materially reduce civil costs

- OFCOM should consider the long-term implications of "stranded" investment by multiple operators at street cabinet level

- 1/3 of the UK population may not be economically viable to cover without some creative public/private coordination.

More comments as I wade through this beast.

UPDATE: Very interesting "geotype"-based cost analysis contained here, which seems to bear out what I've heard anecdotally from a number of people actively involved in fiber deployments - namely that the cost differential between PON and P2P is on the order of only 10 - 15%, at least in high density areas. That's the good news. The bad news is that someone is going to have to come up with £25 - 30bn for universal national PON/P2P coverage - that's the equivalent of 8 - 10 years of capex for BT at the current run-rate. On the positive side, 2/3 of the country could be covered for a more modest £10 - 12bn (for perspective, BT's market cap is currently £13.5bn). Obviously, FTTC/VDSL is dramatically cheaper, apparently allowing coverage of 60% of the country for £2bn, which puts it within BT's capex envelope and unsurprisingly is the direction the company has taken so far.

For the remaining 1/3 of the country which I assume will be left out in the near term, in more normal economic conditions, I would assume that local initiatives and entrepreneurial capital could fill the gaps (we have seen it before and there are other examples taking shape elsewhere) to some extent, but I'm struggling to see that happening in the UK in the current climate. Nor do I envisage much political vision given the current Punch-n-Judy state of UK politics. My initial sense is that, in the absence of the kind of partial mutualization of infrastructure between BT and Virgin envisaged as one scenario in the report, what we are likely to end up with for the foreseeable future is an urban-focused battle between FTTC and DOCSIS 3.0, with BT opportunistically cherry-picking desirable areas with FTTH, and Virgin, carrying four turns of leverage, having not a lot of scope to respond. I hope I'm wrong...

Sunday, September 07, 2008

It's official - Snap Shots do in fact suck

I've seen enough in the survey results - 92.3% of you apparently think they are annoying and distracting, and a few of you have been kind enough to leave some highly amusing comments, such as, "They suck hard - if you have to ask, you already know..." Another points out that the experience is particularly painful on a mobile browser. Fair enough, Snap Shots are hereby banished into Room 101.

More squandered opportunities

I've moaned about this previously, albeit a bit more under the radar, but the extensive gas network refurbishment work going on in our area continues. A lot of trenches are being dug, and a lot of disruption created, but not one strand of fiber in sight.

Yours in coax,

Disgusted of Dulwich

The week ahead

Assuming the world doesn't actually come to an end on Wednesday, this should be an interesting week. I'm catching up with a number of fascinating people I haven't seen in some time, and I am determined to post in a more consistent manner. Should also be another challenging week in the financial markets, on the heels of some exceptionally nasty developments (this latter example is really discouraging, considering that cars were strictly rationed in the UK until 1968 - just kidding).

Friday, September 05, 2008

Do Snap Shots suck?

I've been using Snap Shots previews on this blog for some time now, but I have received an impassioned email from a Platinum Club mega-uber value reader imploring me to remove the service from the site. I've previously thought that it was helpful for readers to be able to preview links, and that the ability to play video clips, etc., without leaving the site was pretty handy. However, if they are a distraction to the readership, then perhaps I need to think again. Let me know - take the EuroTelcoblog survey.

Thursday, September 04, 2008

Got 15 minutes?

The good and clever people over at Telco 2.0 have a survey they'd like you to fill out, on the topic of internet video distribution and its implications, a theme which we spent a lot of time working on when I was part of the Thundering Herd. We looked at a number of interesting investment opportunities in the value chain, but could never get comfortable enough to commit, preferring instead to look at some of the enablers, beneficiaries, and potential victims of the phenomenon. Anyway, enough about me - please help out and take the survey, and in return, you'll receive the summary survey results when it's completed.

Wednesday, September 03, 2008

Ouch of the day, 3rd September

When I first joined an unnamed previous employer a number of years ago, I was on the receiving end of a corporate email experience like this, but the executive in question had erroneously circulated a list of potential hires (with highly personal comments and salary details), rather than fires. To make matters worse, the message was accidentally copied to a large number of clients as well as employees. This email genius has since gone from strength to strength in the company, demonstrating the frequently inverse relationship between basic technical competency and career development.

Feeling defensive?

One of the few good things about getting sacked from a bank is that, if you're a Bloomberg user, you occasionally get a free trial subscription to the service for 60 days after your "right-sizing". Mine was just activated today, and it's nice to be able to play around with this wonderful tool again after a hiatus (one strange aspect of the "consultation period" in UK employment law being that, once identified as being "at risk of redundancy", you are sometimes thereafter treated as a de facto outsider, and barred from accessing corporate IT, at least this was the case for me - really gives you a warm, fuzzy sort of feeling...).

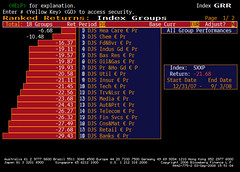

Anyway, rant aside, I was getting back in the loop of market technicals today, and downloaded this chart of ranked returns in the DJ STOXX 600 industry groups. Historically, I think many analysts, including yours truly on some occasions in the past, have argued that telco is a defensive sector in a market downturn (as it was at least for three months following 9/11). It's therefore interesting to note that telco, on a year-to-date basis, is 14th out of 18 sectors (down 26%), and the ones below it are non-bank financials (i.e., consumer credit, et al), construction and construction materials, retail, and banks.

In other words, telco is just managing to outperform the four sectors universally acknowledged as obvious casualties of the credit hangover. But wait, broadband and mobile are established as essential services, like electricity and water - what's going on here? De-leveraging is complete, the era of stupid M&A (DT aside) is over, "market repair" is complete or underway in a number of markets, so what's the problem?

I'll be honest and say I don't really know. Looking at the rankings on a one month basis, telco rates 12th out of 18, on a three-month basis it's number seven, and on six months, number 14. So clearly there's a lot of volatility in investor sentiment, but in all four cases, the financials are somewhere close in the rankings. I'm sure telcos would love to be acknowledged as serious financial services players, but there are no examples yet in Europe to warrant such an association - and I can't see any obvious factors to explain such an apparently strong correlation.

Anyway, rant aside, I was getting back in the loop of market technicals today, and downloaded this chart of ranked returns in the DJ STOXX 600 industry groups. Historically, I think many analysts, including yours truly on some occasions in the past, have argued that telco is a defensive sector in a market downturn (as it was at least for three months following 9/11). It's therefore interesting to note that telco, on a year-to-date basis, is 14th out of 18 sectors (down 26%), and the ones below it are non-bank financials (i.e., consumer credit, et al), construction and construction materials, retail, and banks.

In other words, telco is just managing to outperform the four sectors universally acknowledged as obvious casualties of the credit hangover. But wait, broadband and mobile are established as essential services, like electricity and water - what's going on here? De-leveraging is complete, the era of stupid M&A (DT aside) is over, "market repair" is complete or underway in a number of markets, so what's the problem?

I'll be honest and say I don't really know. Looking at the rankings on a one month basis, telco rates 12th out of 18, on a three-month basis it's number seven, and on six months, number 14. So clearly there's a lot of volatility in investor sentiment, but in all four cases, the financials are somewhere close in the rankings. I'm sure telcos would love to be acknowledged as serious financial services players, but there are no examples yet in Europe to warrant such an association - and I can't see any obvious factors to explain such an apparently strong correlation.

Tuesday, September 02, 2008

Shameless self-promotion, 3.0

The good people at TEN in the UK have invited me to moderate their upcoming event, tantalizingly entitled "The Broadband Customer Expectation Dilemma: Why What You See Isn’t What You Get." With a title like that, especially in the UK market, one could easily expect the discussion to cover a couple of days, but sadly it's limited to a single evening, 15th September. Should be a colorful exchange. Hope to see you there.

What's in the AlcaLu chalice?

Apart from the Franco-American culture clash poison with which Pat and Serge consummated their suicide pact, I'm not really sure. I have an awful lot of respect for Ben Verwaayen and the turnaround he achieved at BT, but that was a very different kettle of fish and chips. Yes, it was an overstretched, over-leveraged empire which had engaged in a lot of strange M&A and joint ventures with very strange put/call terms with partners. An aggressive 3G license acquisition strategy certainly didn't help the balance sheet - in fact BT's decline from net cash position to rescue rights issue and de-merger of O2 was nothing short of stunning, if only for the sheer velocity with which it occurred.

But, apart from all the crap, underlying the company was a (relatively) stable, cash-generative, regulated monopoly business in the UK, with smarter management and more customer inertia than many might have thought at the time, which gave it some sort of visibility on restructuring, repositioning and continuity. I wouldn't want to trivialize the turnaround of BT - it wasn't a lay-up - nor by any means would I judge it an unmitigated success (21C, Fusion, anyone?). But financially speaking, it's a historical fact, and one that Mr. Verwaayen can be proud of.

Then again, BT didn't have private, national champion competitors in its core market with presumably near-infinite financing sources. I hear through the grapevine that it is not uncommon for pricing in competitive situations to be 30% below the lowest bid from the usual suspects, with vendor financing well north of 100%. I think this is bound to be an intractable problem at AlcaLucatel. We may recall that three years ago, many commentators cited this as precisely the situation which ultimately ensured Marconi's demise, in the tender process for - wait for it, BT's 21C. I trust Mr. Verwaayen has a good appreciation of historical irony, but I don't envy his position.

But, apart from all the crap, underlying the company was a (relatively) stable, cash-generative, regulated monopoly business in the UK, with smarter management and more customer inertia than many might have thought at the time, which gave it some sort of visibility on restructuring, repositioning and continuity. I wouldn't want to trivialize the turnaround of BT - it wasn't a lay-up - nor by any means would I judge it an unmitigated success (21C, Fusion, anyone?). But financially speaking, it's a historical fact, and one that Mr. Verwaayen can be proud of.

Then again, BT didn't have private, national champion competitors in its core market with presumably near-infinite financing sources. I hear through the grapevine that it is not uncommon for pricing in competitive situations to be 30% below the lowest bid from the usual suspects, with vendor financing well north of 100%. I think this is bound to be an intractable problem at AlcaLucatel. We may recall that three years ago, many commentators cited this as precisely the situation which ultimately ensured Marconi's demise, in the tender process for - wait for it, BT's 21C. I trust Mr. Verwaayen has a good appreciation of historical irony, but I don't envy his position.

Ouch of the day

I've met quite a few people over the years who came out of Oracle and went on to do interesting things, but never anyone who went back - particularly not after only nine months with one of the "hottest companies on the planet" (which was apparently ready to reward stamina). God knows what's behind this, but it can't be very pleasant or satisfying for either side.

Family Affair

For anyone interested in the changing dynamic of how companies in search of growth capital will access funds in a time of mounting financial pain, there is an interesting piece in the second half of the BBC World Service's Business Daily show today (UPDATE NOTE on 9 September 2008: originally this link pointed to the specific program in question, but as far as I can see, the BBC posts links to this show on a seven-day rolling basis, meaning that old content apparently just disappears - STUPID. If anyone knows otherwise, please let me know, but I can't find the original broadcast.) focusing on the growing numbers of foreign family offices setting up in London. Coupled with the sovereign fund wild-card and those hedge funds with both dry powder and imagination, I assume these investors are going to disproportionately reap the rewards of what's happening now. Presumably, if anyone were interested (which I think is questionable), there's more than enough raw material out there now to build a brand new investment banking franchise from scratch...

Monday, September 01, 2008

Rudolf is Sub-Zero

I imagine young Mr. Van Der Berg will be getting some colorful email in response to this little gem. I have so few points on which to disagree here that it's not worth adding anything. Just read and enjoy, unless you're one of the many large and possibly deluded organizations which he consigns to the Uncool Vortex.

Presentations partially restored

I am working to restore a number of links to presentations and reports/notes, which can be found here and here. Only those which point to Scribd are live - I'm struggling to locate some of the older ones, to my dismay. I'll amend as (and if) I am able, though going back through the blog and trying to re-do individual links is probably above my tedium threshold.

From the bottom of Lake Woeisme

What passes for summer in the UK has ended, the kids are back to school next week, and frankly I've been feeling a little sub-prime in confronting my new status, or lack thereof. None of this is helped in the least by newsflow. The Centre for Management Buy-out Research at Nottingham University last week released stats (oddly, not on their site yet) showing that the value of private equity transactions in Europe was down by nearly two-thirds in the first half of 2008. Disheartening, but hardly unexpected. European venture investing is tracking historic lows. We're all facing some very ugly systemic problems in the credit markets (check out the very scary charts on credit spreads in this particularly gloomy read from the ever-excellent John Mauldin), and Christmas is definitely going to be canceled for an awful lot of people in my industry as the investment banks aggressively eviscerate themselves and engage in M&A (either under political duress, or out of desperation). You could be forgiven for thinking we were on the eve of destruction, living on a dead-end street - and you may yet be right.

However, at times like these, we have to take delight in small pleasures and rare snippets of good news. Taking a break from my dark reflections to check my site traffic earlier today, I saw a number of hits from two sources I haven't seen in ages. Old blog buddy Dean Bubley claims I was an inspiration, which I consider very gratifying, to say the least. There I was thinking that I was just one in 4,000, or maybe even just half a man, but Martin Geddes, the godfather of disruption, says I'm "The One". Don't know how I will ever live up to that, but it's just the ray of light at the bottom of the black lagoon which I needed to see right about now. Many thanks gents, you don't know what it means.

These go to 11

BT's latest HomeHub billboard assault. Caption reads: "Up to twice the wireless range of any other UK broadband provider, so you get a better connection." Available in black - very heavy metal.

Subscribe to:

Comments (Atom)